RECENT RESEARCH

My recent and current research agenda focuses on the modeling and prediction of financial asset returns. In particular, my team and I develop and study multivariate stochastic processes suitable for complex data arising from a variety of financial instruments. By calibrating these constructs to real data with sophisticated statistical methodologies, we can make accurate predictions of risk and return.

This, in turn, leads to algorithms for improved asset allocation. We derive optimal investment strategies and portfolio weights, through time, for a given universe of risky assets, such as stocks, bonds, currencies, options, crypto-currencies, and commodities, accounting also for transaction costs and illiquidity issues.

To get an idea of the improvements we obtain, Graphic 1 shows the performance of some of our models when applied to the stocks of the DJIA (top lines; total return over time) versus existing investment strategies (bottom lines) such as equally weighted (1/N), Markowitz, and traditional GARCH.

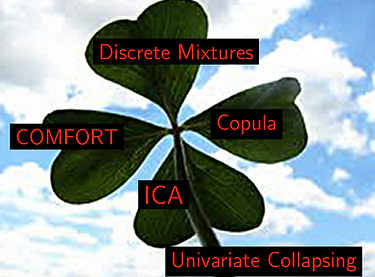

The various methods I work on can be divided into five categories (see Graphic 2). The top four are based on multivariate constructs, and all support large-dimensional asset universes, despite the proliferation of parameters and the "curse of dimensionality". The fifth method is for multivariate portfolio allocation, but makes use of only simple, univariate models that have been augmented with extremely fast statistical and numerical approximation procedures to allow it to work.

Graphic 1: Performance of competing methods

Graphic 2: Five different categories of methods

The academic papers associated with these five methods are listed below in their respective categories.

The "COMFORT" methodology (acronym for COmmon Market Factor nOn-Gaussian ReTurn Model) is arguably the most interesting one from a purely theoretical / academic viewpoint, and is among the best performers. The third graphic shows a diagram indicating the core COMFORT model and the numerous extensions we are working on.

A famous quote (often attributed to Kong Tzu, better known as Confucius) is "A scholar who cherishes the love

of comfort is not fit to be deemed a scholar." There is much truth to this, as we need to relentlessly study and learn new things,

both for the sake of learning, and in order to generate worthwhile new research --- which is often very challenging and time-consuming. However, in our case, "COMFORT" is a core part of our academic efforts! We knew this is a promising and fortuitous approach---the fortune cookie we received, pictured on the right ("You will always be surrounded by comfort") is real.

A complete list of my published research work, along with citation information, can be found on my Google Scholar page.

Discrete Mixtures

2025

Low Dimensional Home Bias Portfolio Optimization

S. Chitsiripanich, M. Paolella, and P. Polak

2017

Robust Normal Mixtures for Financial Portfolio Allocation

M. Gambacciani and M. Paolella

Econometrics and Statistics, 3, pp. 91-111

2015

Multivariate Asset Return Prediction with Mixture Models

M. Paolella

European Journal of Finance, 21(13-14), pp. 1214-1252

2013

Stable Mixture GARCH Models

S. Broda, M. Haas, J. Krause, M. Paolella, and S.-C. Steude

The Journal of Econometrics, 172(2), pp. 292-306

2012

Mixture and Regime-Switching GARCH Models

M. Haas and M. Paolella

In Bauwens, L., Hafner, C., and Laurent, S., (eds.)

Handbook of Volatility Models, John Wiley & Sons

2009

Asymmetric Multivariate Normal Mixture GARCH

M. Haas, S. Mittnik, and M. Paolella

Computational Statistics and Data Analysis, 53(6), pp. 2129-2154

2008

An Econometric Analysis of Emission Trading Allowances

L. Taschini and M. Paolella

Journal of Banking and Finance, Vol. 32, pp. 2022–2032

2004

A New Approach to Markov-Switching GARCH Models

M. Haas, S. Mittnik, and M. Paolella

Journal of Financial Econometrics, 2(4), pp. 493-530

2004

Mixed Normal Conditional Heteroskedasticity

M. Haas, S. Mittnik, and M. Paolella

Journal of Financial Econometrics 2(2), pp. 211-250

Continuous Mixtures / COMFORT

2025

A New Class of Heterogeneous Tail Models for Financial Asset Returns

M. Paolella, P. Polak, and F. Sandmeier

2025

Risk Parity Portfolio Optimization under Heavy-Tailed Returns and Dynamic Correlations

M. Paolella, P. Polak, and P. Walker

Journal of Time Series Analysis, 46(2), pp. 353-377

2023

Heterogeneous Tail Generalized Common Factor Modeling

S. Hediger, J. Näf, M. Paolella and P. Polak

Digital Finance, 5:389-420.

2021

A Non-Elliptical Orthogonal GARCH Model for Portfolio Selection under Transaction Costs

M. Paolella, P. Polak, and P. Walker

Journal of Banking and Finance (available online)

2019

Regime Switching Dynamic Correlations for Asymmetric and Fat-Tailed Conditional Returns

M. Paolella, P. Polak, and P. Walker

Journal of Econometrics, 213(2), pp. 493-515

2019

Heterogenous Tail Generalized COMFORT Modeling via Cholesky Decomposition

J. Naef, M. Paolella, and P. Polak

Journal of Multivariate Analysis, 172, pp. 84-106

2015

COMFORT: A Common Market Factor Non-Gaussian Returns Model

M. Paolella and P. Polak

Journal of Econometrics, 187(2), pp. 593–605

Fractional Differencing for

Portfolio Optimization

2025

Momentum Without Crashes

S. Chitsiripanich, M. Paolella, P. Polak, and P. Walker

2025

Smoothing Out Momentum and Reversal

S. Chitsiripanich, M. Paolella, P. Polak, and P. Walker

Copula

2018

COBra: Copula-Based Portfolio Optimization

M. Paolella and P. Polak

In Kreinovich, V., Sriboonchita, S., and Chakpitak, N. (eds.)

Predictive Econometrics and Big Data, Springer-Verlag, pp. 36-77

ICA

2009

CHICAGO: A Fast and Accurate Method for Portfolio Risk Calculation

S. Broda and M. Paolella

Journal of Financial Econometrics, 7(4), pp. 412-436

2015

ALRIGHT: Asymmetric LaRge-Scale (I)GARCH with Hetero-Tails

M. Paolella and P. Polak

International Review of Economics and Finance, 40, pp. 282-297

Univariate Collapsing

2017

The Univariate Collapsing Method for Portfolio Optimization

M. Paolella

Econometrics, 5(2), article 18, pp 1-33

2014

Fast Methods for Large-Scale Non-Elliptical Portfolio Optimization

M. Paolella

Annals of Financial Economics, 9(2)

Risk Calculation

2018

Approximating Expected Shortfall for Heavy-Tailed Distributions

S. Broda, J. Krause, and M. Paolella

Econometrics and Statistics, 8, pp. 184-203

2014

A Fast, Accurate Method for Value-at-Risk and Expected Shortfall

J. Krause and M. Paolella

Econometrics, 2, pp. 98-122

2013

Time-varying Mixture GARCH Models and Asymmetric Volatility

M. Haas, J. Krause, M. Paolella, S.-C. Steude

North American Journal of Economics and Finance, 26, pp. 602-623

2011

Expected Shortfall for Distributions in Finance

S. Broda and M. Paolella

In Cizek, P., Haerdle, W., and Weron, R., (eds.)

Statistical Tools for Finance and Insurance, 2nd edition, Springer Verlag

2008

Risk Prediction: A DWARF-like Approach

M. Paolella and S-C. Steude

The Journal of Risk Model Validation, 2(1), pp. 25-43

2006

Value-at-Risk Prediction: A Comparison of Alternative Strategies

K. Kuester, S. Mittnik, and M. Paolella

Journal of Financial Econometrics 4(1), pp. 53-89

2003

Prediction of Financial Downside–Risk with Heavy–Tailed Conditional Distributions

S. Mittnik and M. Paolella

In Rachev, S. T. (editor)

Handbook of Heavy Tailed Distributions in Finance, Volume 1, Chapter 9, Elsevier North–Holland

2000

Value-at-Risk Prediction: A Comparison of Alternative Strategies

K. Kuester, S. Mittnik, and M. Paolella

Journal of Financial Econometrics 4(1), pp. 53-89

2000

Conditional Density and Value-at-Risk Prediction of Asian Currency Exchange Rates

S. Mittnik and M. Paolella

Journal of Forecasting, 19, pp. 313-333

2000

Diagnosing and Treating the Fat Tails in Financial Returns Data

S. Mittnik, M. Paolella, and S. Rachev

Journal of Empirical Finance, 7

1999

A Simple Estimator for the Characteristic Exponent of the Stable Paretian Distribution

S. Mittnik and M. Paolella

Mathematical and Computer Modelling, 29

Distributional Computation and Testing

ARIMA Time Series Analysis

2016

Stable-GARCH Models for Financial Returns: Fast Estimation and Tests for Stability

M. Paolella

Econometrics, 4(2), Article 25

2016

Asymmetric Stable Paretian Distribution Testing

M. Paolella

Econometrics and Statistics, 1, pp. 19-39

2015

New Graphical Methods and Test Statistics for Testing Composite Normality

M. Paolella

Econometrics, 3(3), pp. 532-560

2017

Autoregressive Lag–Order Selection Using Conditional Saddlepoint Approximations

R. Butler and M. Paolella

Econometrics, 5(3), pp. 1-33

2009

Assessing and Improving the Performance of Nearly Efficient Unit Root Tests in Small Samples

S. Broda, K. Carstensen, and M. Paolella

Econometric Reviews, Vol. 28(5), pp. 1-27

1998

Approximate Distributions for the Various Serial Correlograms

R. Butler and M. Paolella

Bernoulli, 4(4), pp. 497-518

2009

Evaluating the Density of Ratios of Noncentral Quadratic Forms in Normal Variables

S. Broda and M. Paolella

Computational Statistics and Data Analysis, Vol. 53(4), pp. 1264-1270

2008

Uniform Saddlepoint Approximations for Ratios of Quadratic Forms

R. Butler and M. Paolella

Bernoulli, Vol. 14(1), pp. 140-154

2007

Saddlepoint Approximations for the Doubly Noncentral t Distribution

S. Broda and M. Paolella

Computational Statistics and Data Analysis, Vol. 51, pp. 2907-2918

2002

Saddlepoint Approximation and Bootstrap Inference for the Satterthwaite Class of Ratios

Journal of the American Statistical Association, 97(459), pp. 836-846

2002

Calculating the Density and Distribution Function for the Singly and Doubly Noncentral F

Statistics and Computing, 12(1), pp. 9-16

2002

Stationarity of Stable Power–GARCH Processes

S. Mittnik, M. Paolella, and S. Rachev

Journal of Econometrics, 106, pp. 97--107